Negotiating Bad Credit Car Financing in South Florida

What a long, intimidating word for most car buyers. Thinking about what you’re going to do when you start the car buying process can be daunting. This article will help give you some pointers on how to successfully get that car with the best deal possible.

When car salesman negotiates car deals every day, you can feel as if you’re at a major disadvantage when you want a discount and the dealer just won’t budge on the price or the payments. These tips will help you have an edge when negotiating a car purchase, and especially when buying a car with subprime credit.

Get Approved First

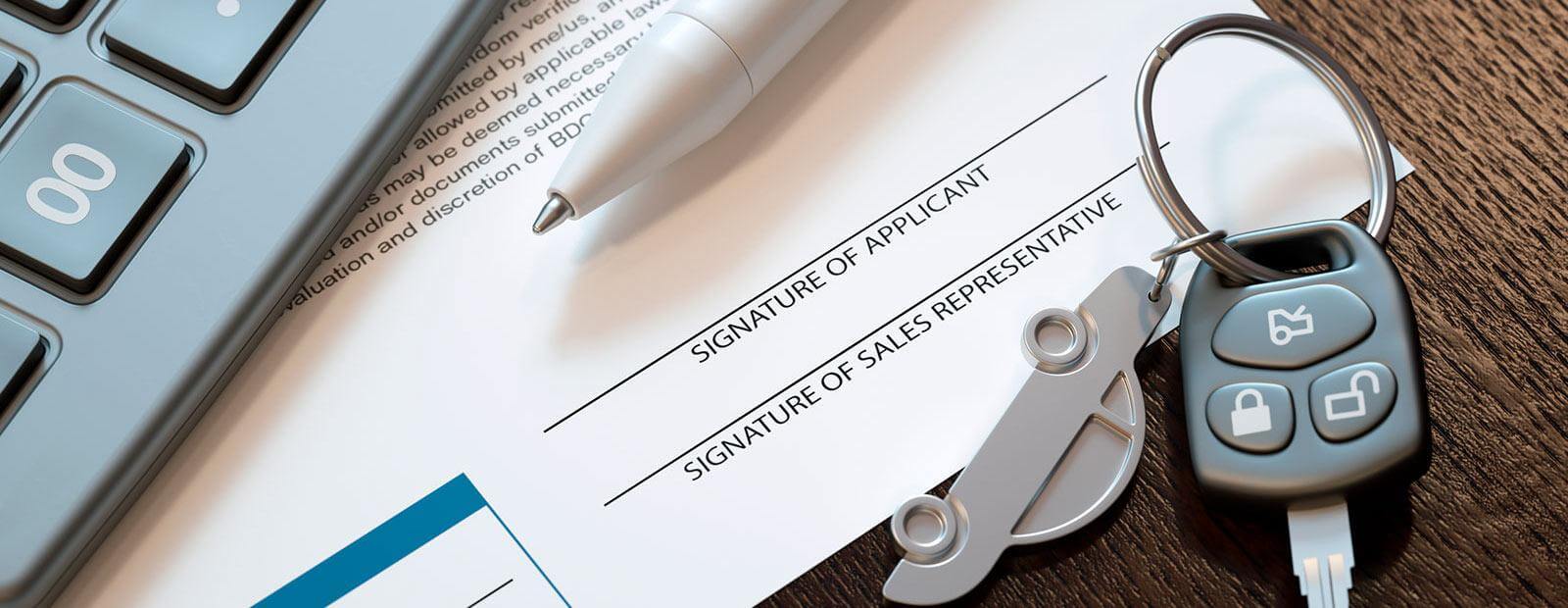

Rather than driving from one dealership to the next, test driving cars with no idea if you can get approved or not, get your financing approved first.

This is usually not the way cars are bought when you have bad credit. Most of the time, car dealerships expect to show you a car or two, have you fill out a credit application and then tell you what you can and can’t get approved for.

It’s a frustrating experience for many people.

Even worse is spending time at a car dealership getting your hopes up for a particular vehicle only to be told you can’t get approved, or the payments are going to just be too high for your budget.

The best thing to do is to get your financing approved in advance.

Did you know there are companies, some on-line, that specialize in helping people with sub prime credit to get approved for auto loans?

Getting your financing approved before you shop for your next vehicle offers significant advantages.

- You won’t have to waste your time looking at or test driving vehicles that you can’t get approved for or that are not in your budget.

- You can choose the vehicle you want based on a set amount. This allows you to better narrow down your search for the best vehicle for you, easier.

- When you’re already pre-approved, you’re in a better position to negotiate the price.

- You’ll already have an idea of the interest rate you can expect.

- What’s better than knowing you’re already approved?

Negotiating Price

Most all dealerships offer you an initial price higher than they will accept. This is to raise your expectations of how much you’ll have to pay. When they lower the price from their initial offer, you have the illusion of a discount. They allow you to feel as if you’ve “won” and when you accept the lower price, thinking you’ve got a discount – you’re really only accepting what they wanted you to pay to begin with.

You can use an online auto loan calculator to determine what your monthly payment will be with your down payment, trade in, and interest rate. This is good to use so you have a ballpark figure on what you are looking to spend each month and how much you need to put down to bring the payment down to the amount you can afford each month.

You can turn this around.

Make a Low Counter Offer

Usually when buying a car, the price is negotiated first and the financing arranged second. With your financing already pre-approved, you’re now in the position to make a true offer as a buyer. Don’t ask for a lower price. Tell the dealership what you would be willing to pay, and when you do make a counter offer, offer a price $1500 – $2000 less than the price you would like to pay.

Remember, regardless of what you offer to pay – the dealer is always going to try to “bump” you.

This is industry lingo for trying to get you to agree to just a bit more than you are wanting to pay. So use this to your advantage by always offering a good bit less than you expect the final price to be. Most dealerships don’t expect car buyers to do this and this will allow you to see just how low the dealer will go.

Then when you concede from your offer, you’re getting a better price than what you would have, had you not asked for such a substantial discount.

Auto lenders at financial institutions will usually offer you loan terms easily with good credit, however if you have bad credit or poor credit and need to build your credit back up or improve your credit your monthly payments will usually be higher due to the higher risk.

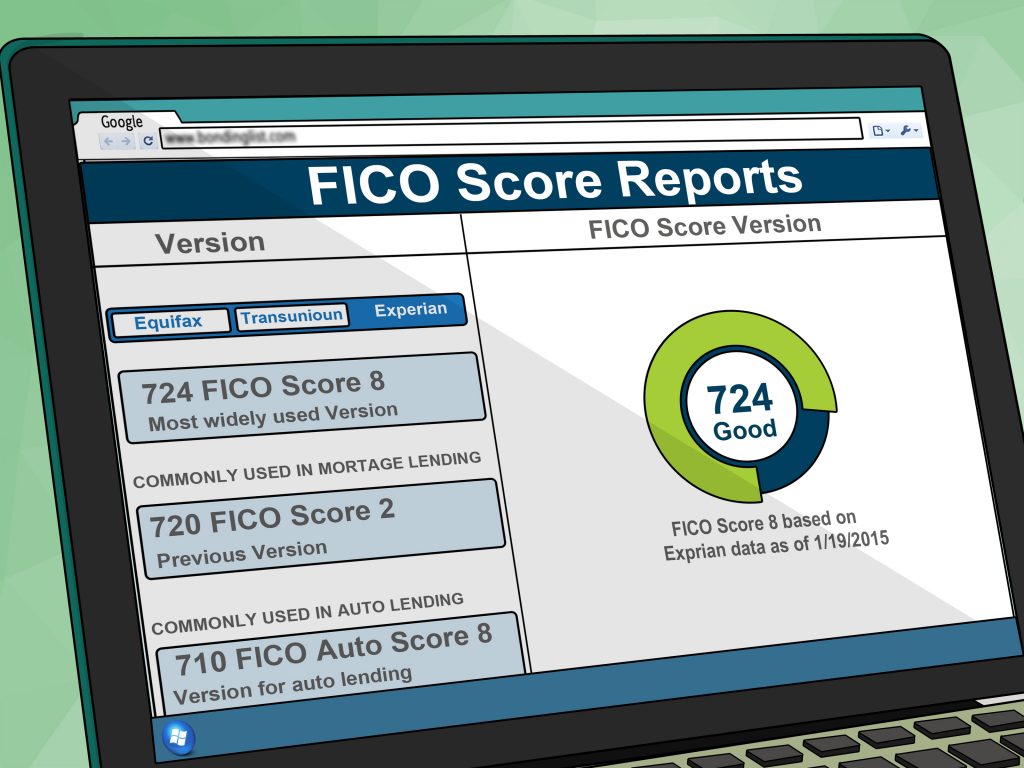

If your Fico score is below a 640 than you would be considered subprime auto financing. These will come with higher interest rates from online lenders or banks and credit unions. Check your credit history to see if there are anything you can dispute or pay off to help bring your score back up.

There are plenty of resources to help you such as credit karma and others. Also look at 84 month loans which usually take longer to pay off but will yield lower monthly payments.

Be Prepared to Walk Away

When you’ve already arranged your financing, know what you can get approved for, and have made an offer on a vehicle… be prepared to walk away.

Once a salesman has invested his time in showing you a vehicle, taking you on a test drive, and negotiating figures, you have a negotiating advantage.

If you’re willing to walk away from a higher price than you’re willing to pay, the salesman will want to do whatever he can to make the time he’s invested with you worthwhile. Just a simple gesture of standing up and saying you’re going to have to think a bit more about their offer will most likely result in the salesman asking you to stay to reconsider.

If the salesman doesn’t try to make the numbers more attractive at this point, he doesn’t want to sell a car.

Most every time, by simply standing up and saying you want to think this over for a while, the salesman will do whatever they can to complete a sale.

So don’t agree to any price or payments before you’ve seen what the dealership will do to earn your business. Being willing to walk away from a “deal” will not only help you to save money when buying a car with bad credit, it’s also a smart attitude to have. You’re the buyer and they want to sell a vehicle more than you want to buy one. Use this to your advantage when negotiating and you’ll get a much better deal on your next vehicle.

How To Buy A Car after Repossession

How To Buy A Car after Repossession

After repossession, you may find yourself with several issues to deal with at once. First of all, you will be without a vehicle, and will have to find other ways to get around until you’re able to get another car. Secondly, you could still owe money on a vehicle that you can no longer drive.

When you are financially capable of replacing the repossessed car, you will probably find that your credit isn’t in the best shape. And it can be difficult to get auto loan approval if your credit is damaged. But before getting too discouraged, remember that it is possible to fully recover from auto repossession, but it will take time, patience and some careful budgeting.

The Aftermath of Auto Repossession

If your car is repossessed, you will still be responsible for what you owe on the auto loan. It is likely that the car will be sold at auction, and the selling price will go towards your balance, but you will have to cover the remaining amount. For example, if your repossessed vehicle sells for $5,000, but your loan balance is $7,000, you will still owe the lender $2,000.

It is also likely that you will be charged any fees that are associated with the repo. And because financial problems may have led to the repossession, finding out that you still owe a substantial amount of money will definitely not help your situation.

This is when you have to put some real thought into what you’re going to do next.

- Stick to a strict budget and pay what you owe. While it may be a huge financial burden, if you are able to settle up with the lender, you will avoid further complications. And even though you will still be without a car and have a repo on your credit report for about seven years, you will at least be able to stop any further damage from happening.

- Consider bankruptcy as an option. Declaring bankruptcy should always be a last resort, but it may be your best solution if you still owe a lot of money after repossession. If you are unable to pay the amount that you owe the lender, your account could be sent to collections. You may even face legal action and further damage to your credit. And, yes, bankruptcy will do substantial harm to your credit rating, but you will at least get some protection and a fresh start to rebuild once you have been discharged.

After you have made it completely through the repossession, you will probably be anxious to put the event behind you and get on with life in a replacement car. And, until your credit is fully restored, you may have limited vehicle buying options. However, you may be able to get back on the road sooner than you think.

Getting an Auto Loan after Repossession

Again, your credit will be negatively impacted for at least seven years after repossession, but there is a good chance that you will need to buy a car well before those seven years are up. With this in mind, here are three options to consider.

- You can buy an inexpensive car with cash. There are plenty of private sellers out there with vehicles to sell. And while this may seem like the easiest solution to an immediate problem, buying a car with cash will do nothing to improve your credit score. Also, you could end up with an unreliable vehicle that will cost you a fortune in repair bills.

- You can finance a vehicle with a bad credit auto loan. There are lenders out there that are willing to work with bad credit car buyers. If you are approved for this type of “special financing,” you will have an opportunity to rebuild your credit by consistently making your payments on time. However, even special finance lenders normally require you to wait a year after repossession before they will consider your loan application.

- You can purchase a car from a Buy Here, Pay Here (BHPH) dealer. This may your best bet if you need a car immediately after your repo. These dealers typically do not run credit checks and only require a valid driver’s license, residency verification and proof of income. And while many BHPH dealers do not report positive payment activity to the credit bureaus, some do. If possible, try to work with a Buy Here, Pay Here dealership that will allow you to give your credit rating a boost by reporting all of your timely payments.

After repossession, buying a car with a bad credit auto loan is the best course of action for most consumers. With this option, you will get the vehicle you need and a chance to significantly improve your credit. And if you’re ready to get back on the road and on your way to a better credit rating, E-Z Pay Cars can help.

Easy Financing after Repossession

Going through repossession or any sort of financial trouble is hard, but financing a vehicle with damaged credit can be easy and hassle-free. E-Z Pay Cars can work with your situation and get you back on the road fast.

Just fill out our simple and secure online application to get started today.

How To Get Items Removed From Your Credit Report

How To Get Items Removed From Your Credit Report

Having a good credit score is an important part of your financial life. At the very least, it will affect the type of interest you’ll pay on any type of loan, from Auto Loans, home mortgages, and credit cards. At most, a low credit score will seriously impact your ability to purchase a house or a car. Yet a lot of people still have doubts as to how credit scores work and why it’s important to make sure the information contained in your credit report, which is the basis for your score, is correct.

Know What Goes into Your Credit Report

Knowing the information that goes into your credit report is important not only because it will give you an idea of your financial health, but also because it can help you identify inaccurate information. It can also help identify if you’ve been the victim of identity theft.

“Your credit report can be one of the first sources to help protect you and help you recover from fraud,” says Rod Griffin, Senior Director of Public Education for Experian. “It’s also an account management tool. When you get your credit report you’ll be able to see all of your financial debt-related obligations and help you manage them more effectively.”

Learning the ins and outs of credit reporting can be confusing if you don’t know where to look. The first step is to obtain and review your credit report at least once a year. Next, you want to know what information goes into creating your score and what factors can negatively affect it. Finally, you’ll need to know what you can do to help improve your score if possible. Your credit report will include a list of risk factors that can reduce your score. “Get those risk factors,” said Griffin. “They will tell you exactly what you need to work on in your credit report to make those scores better.”

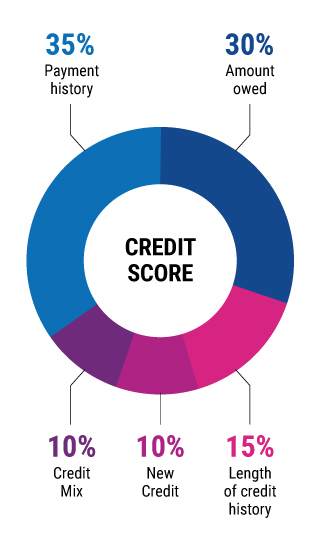

Know What Makes Up Your Credit Score

Your credit score is composed of five categories: your payment history (35%), the amounts you owe (30%), the length of your credit history (15%), your credit mix (10%), and new credit (10%). Changes to any one of these categories can change your score, so maintaining a good score entails making payments on time, not owing too much, having a good balance of different kinds of debt (mortgages, credit cards, installment loans, etc.), opening new credit lines, and not using too much of your available credit.

Some less serious factors that can lower a credit score include not having a long credit history or having a high credit utilization. For example, someone who only has one or two years of payment history may not have a high score simply because there isn’t enough information for the lender to decide whether they are creditworthy. Another example is someone who has three credit cards with a $30,000 total credit limit between the cards. If they only carry a debt of $5,000 on those cards their credit score will be higher than if they carry a debt of $25,000.

Other factors that reduce a credit score, however, are much more serious and can have a longer-lasting effect on your ability to obtain new credit.

Negative Impacts on Your Credit Score

The following behaviors will not only lower your credit score and cause trouble in your financial life, but they will also stay on your credit report for up to seven years in most cases, significantly impacting your ability to obtain new credit or qualify for lower interest rates:

- Late Payments or Non-payment: Payment history accounts for a large chunk of your credit score, so if you are chronically late or not paying at all, it will hurt your score significantly. It also signals lenders that you cannot afford, or are unwilling, to pay your debts. According to Equifax, a single late payment that is overdue by 30 days can cause a point drop in some cases.

- Having a charge-off: A charge-off happens when a creditor has given up on you ever paying your debt and they “charge off” your account. This could cause a credit score drop of 100 points or more in some cases.

- Bankruptcy: Bankruptcy is an extreme measure and will hurt your credit score by up to 200 points or more. It also stays on your record for seven to ten years, depending on the type of bankruptcy.

- Foreclosure: A foreclosure is another red mark on your credit that can cause a credit score to drop substantially. FICO reports that a credit score can see up to a 100 point drop from a foreclosure, depending on the consumer’s starting score.

- Repossessions: If your car is repossessed, the credit bureaus may include a note about the repossession in your credit reports that stays for up to seven years. A repo can include many of the negative line items you see here, such as late or non-payment, so the score drop can easily go over 100 points.

- Judgments: A judgment comes when a court is forced to get involved to ensure debt repayment. Credit score impacts can vary but the drop could also be over 100 points.

- Collections: A collection occurs when a creditor resorts to hiring an outside firm to collect payment. Collections fall under payment history, so the hit to your credit score can also be over 100 points.

Identity Theft and Credit Reports

Identity theft occurs when someone steals and uses your personal information. This can wreak havoc on your credit as your information can be used to apply for new lines of credit. If these new accounts go into default, you will be the one responsible for them.

The internet makes your personal information much more attainable to those who may want to take advantage of you. But there are several other ways your identity can be stolen, including:

- Credit card theft

- Browsing an unsecured website

- Malicious software

- Mail Theft

- Phishing scams through email

- Credit card skimming

Identity theft can result in immediate financial loss, credit damage, and anxiety. It can also take anywhere from less than a day to several months or even years to resolve. The longer it takes for you to realize your identity has been stolen, the more difficult it will be to undo the damage that may have been done.

While you can’t completely eliminate the risk of identity theft, you can take precautions to be safer with your personal data. Monitoring your credit report can help you to stay on top of fraudulent charges.

If anything on your report looks suspicious, contact the creditor immediately to report the issue. You may be able to lock or freeze your account temporarily to avoid new charges from being made. Some credit card companies will automatically freeze your account when they spot too many charges at one time or charges that are out of the norm. Contact law enforcement and file a report if you are a victim of identity theft. Doing so will help if you need to dispute fraudulent charges.

You should also notify all credit bureaus about the identity theft. If you freeze your credit for fear you might be a victim of fraud or identity theft no new accounts can be opened, even though lenders and other entities (such as law enforcement) will still be able to access your credit report. You’ll also be able to set up a fraud alert. If a lender tries to access your report they’ll see the alert and take additional steps to ensure the identity of the person applying for credit. An initial fraud alert can stay on your credit report for up to 12 months. An extended fraud alert will stay on your credit report for seven years unless you decide to remove it sooner.

Get a Free Copy of Your Credit Report

You are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion. You can obtain a copy of your free credit report in one of the following ways:

- Online: AnnualCreditReport.com

- Phone: (877) 322-8228

- Mail: Download and complete the request form from AnnualCreditReport.com. Mail the completed form to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

You can also obtain your credit report through the major reporting agencies themselves. You can also sign up for one of these companies’ monitoring services, which include unlimited access to your report.

Equifax: Though this company made headlines in 2017 for a massive data breach, it remains one of the top 3 services to get your credit report. The company provides a few different levels of service if you want to monitor your credit score monthly (as opposed to getting a free, yearly report). Monitoring packages start at $14.95 per month, and the $19.95 per month options (there are two) include, ironically, a host of identity-theft protection options.

Experian: Experian offers a free 30 day trial period before charging you $ $21.95 a month for the monitoring service. With that fee, you get identity-theft protections, fraud-resolution services, and monitoring of your credit score at the big three companies.

TransUnion: For $24.95 a month, TransUnion will monitor your credit scores from all three reporting bureaus in real-time; alert you if someone applies for credit using your name, and features personalized debt coaching services.

Clear Negative Items From Your Credit Report

Keep in mind that if the negative item in your report is accurate and timely, there is nothing you or anyone else can do to remove it. “The Federal Trade Commission has said that you cannot remove accurate negative information prior to the timeframe specified in the law,” says Griffin. These negative items will remain in your report for seven years, although in some cases there may be state laws that will reduce that term. Check your state laws to see what the time limits are on information placed in credit reports.

If you do find inaccurate or fraudulent information in your report that is driving your credit score down, you have several avenues you can pursue to get that information removed that don’t require spending money. As Griffin says, “Absolutely do it yourself for free.”

Dispute the Information With The Credit Bureau

The Fair Credit Reporting Act (FRCA) requires creditors to report accurate information about each account, so if any entries are incorrect on your credit report, the bureaus are required to investigate and make the appropriate corrections. It’s important to note that you’ll need to dispute the entry with each of the credit bureaus to make sure the removal is complete across the board.

Disputes can be initiated with any one of the credit bureaus through their websites or by mail. When initiating a dispute, it’s important to have documentation and to be clear about what information you are disputing. The credit bureau will then contact the source of the erroneous information and dispute it on your behalf.

Credit reporting bureaus will also provide support if you are the victim of identity theft or fraud. Options they can provide include freezing your credit so no new accounts can be opened in your name or including a fraud alert in your report to alert lenders accessing your information that you are a victim of fraud.

Initiate a Dispute Directly With the Reporting Business

If you decide to dispute a credit report entry directly with a business, which includes credit card issuers and banks, the business is also required to investigate and respond. If the reporting business corrects the issue, you might just save yourself a step. It is important to make sure the items are cleaned up for all three credit bureaus mentioned above.

If you’re worried that trying to work out your debt directly with the lender may somehow reset the clock on the amount of time a negative item will remain on your report, relax. The seven-year retention period starts counting on the date the account was first reported late or unpaid and does not change if you initiate negotiations to pay down the debt.

Hire A Professional Credit Repair Service

When looking at the lifetime cost of bad credit, or if your report is riddled with inaccuracies, paying $100 a month for a reputable company like Credit Saint to help repair your credit is often a reasonable solution. Credit repair services can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Creditor negotiations

Keep in mind that these actions are ones you can handle on your own. However, if your credit repair is complicated, credit repair services might be right for you.

If you do decide to hire a credit repair service, know that there are laws governing how they operate and what they can do. The Credit Repair Organizations Act (CROA) establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a person’s credit status.

- They must provide a detailed description of the service to be provided.

- They cannot receive payment for the performance of any service until said service has been fully performed.

- There must be a written contract detailing the services to be performed, the time-frame during which these services will be performed, and the total cost to be paid for those services.

- They cannot promise to remove accurate information from a credit report prior to the term set by law (seven years, ten years for some bankruptcies).

- The consumer will have three days in which to review the contract and cancel without penalty.

While credit repair companies can provide a useful service, make sure you understand what they can and can’t do, and avoid paying high fees before any work has been done.

Get Credit Counseling

If you do find that you need help disputing inaccurate information on your credit report and don’t have the resources to hire professional help, there are several non-profit consumer credit counseling organizations like the National Foundation for Credit Counseling (NFCC), which provides debt counseling services. The NFCC can also help review your credit reports, work with lenders, and help create a debt management plan free of charge.

Pay For Delete

Information that is accurate cannot be disputed the way that inaccurate information can. In a pay-for-delete letter, you offer to pay the debt in exchange for deletion. You can also offer a settlement in exchange for outstanding debt on your credit report. This usually happens when the account has gone to a collection agency. The end game for creditors is getting as much of their money back as they can, so a commitment for payback can be enough of an incentive for the collection agency to remove the negative entry from your credit report. However, the account won’t be completely removed from the credit report. It will appear as a collection account that has been paid, and the original trigger that put the account in your report to begin with (say, non-payment of a loan or credit card), will still appear.

However, this option may not be necessary, since the latest credit scoring models (FICO 9 and Vantage score 3.0) aren’t taking paid collection accounts into consideration when calculating your score. So paid collection accounts aren’t doing as much damage to your score as an unpaid account. You may be better off just paying off the debt and not have to negotiate a pay for delete letter. Evaluate this option thoroughly before choosing it.

Write a Goodwill Letter

It may seem like a long shot, but you can write a letter to the creditor and ask for a “Goodwill Deletion.” If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

In the letter, be sure to assume responsibility for the issue that caused the account to be reported to begin with. Provide an explanation for why the account was not paid and, if you have a good payment history prior to this incident, point it out. There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment.

Wait It Out

It may seem like waiting for a negative item to fall off your credit report is not a real strategy, but it’s a valid plan for some entries. Rebuilding your credit takes time, and there’s no quick fix for some things. Negative items can linger for up to seven years, but their impact on your credit score lessens as time passes. While you wait, you can work on establishing good credit payment practices.

What Doesn’t Work?

There are credit repair strategies that work and some that don’t. Avoid the following if you want to improve your credit:

- Filing for bankruptcy: Your goal is to eliminate bad debt and improve your credit score. Filing for bankruptcy may eliminate your current debt but will severely damage your credit score. It will also linger on your credit report for seven to ten years. Bankruptcy should be a last resort.

- Closing a line of credit that is already behind on payments. This does nothing to remove the debt and actually can serve to work against you since your credit to debt ratio does affect your credit score calculation.

Bottom Line

There isn’t a 100% foolproof way to get an excellent credit score, because of the various puzzle pieces that go into composing the score. You also need to understand that improving your credit score won’t happen overnight. According to Griffin, one of the biggest misperceptions about credit scores is that they can be changed quickly. “Scoring is all about time, so credit scoring systems look at how long you have been paying your debt on time and keeping those balances low,” he says. “If you’ve had some issues, it’s going to take some time to recover.”

Even if you do find a great credit ratio that is working for you, other items can appear on your credit report that can impact your overall creditworthiness. Regularly reviewing your credit report is the best defense you have for protecting your credit.

If you do find yourself in a situation where you need to have negative items removed from your credit report due to incorrect information or fraudulent debt, it’s certainly possible to do so. But the process requires patience, and you must be open to pursuing all available methods.

At EZ Pay Cars, we try to keep the initial cost needed to get the keys to your vehicle low. Cars break down without warning, leaving you with no vehicle to get to where you need to go. This also leaves you with the trouble of having to buy a replacement quickly. We know you don’t always have time to budget when you’re buying a car. That’s why we try to keep your loan and down payments low.

Five Ways to Get the Most Out of Your Budget

1. Take Control of Your Budget

To control your budget, you first need to know what it is. Write down every source of income you have, from jobs to child support payments, on the left side of a piece of paper. On the right side, list everything you spend it on, from your usual morning coffee to your cell phone bill. By adding up the right side and subtracting it from the left side, you can see how much you should have left every month.

2. Avoid Extra Expenses

Crash diets never work. In the same way, neither does cutting out all unnecessary spending. Keep things you get the most pleasure from that cost the least. But cut big budget items or the little things that add up but don’t add to your happiness.

3. Keep Your Favorite Indulgences

Some things can make or break a week. For example, if you treat yourself to fast food once a week, don’t skip it to save up money for your used car. The enjoyment you get from it is worth the money you’ll spend. But, if you’re hitting the steakhouse once a week, you may consider cutting back to once a month as a treat.

4. Create a Social Schedule

Most social events cost more money than you would spend on yourself. Plan a list of activities you can do that won’t cost much money. For instance, meeting for coffee instead of dinner or having a game night instead of going out for a movie.

5. Have a Goal In Mind

It’s easier to save money and say no to extra spending when you have a clear goal in mind. For you, it may be a reliable used car. Visualize yourself in the car whenever you’re tempted to spend a little extra money. Weigh whether delaying that goal is worth the treat you’re considering.

When you have bad credit or lack of credit, it can feel like an impossible task to build your credit to a point where you can get decent offers for loans, credit cards, or a mortgage. However, knowing how to navigate the wide world of credit is key. To boost your credit score, you’ll need to:

- Remember that building credit is a slow-and-steady process.

- Take some crucial steps toward obtaining lines of credit and being responsible with them.

Buying a car can be one of the best ways to raise your credit score as long as you are diligent about making on-time payments. Once you finance a car, you’ll see your loan reflected on your credit report. Make your payments in full and on time, and you’ll slowly start to see that credit score rise.

How Can EZ Pay Cars Help Me Raise My Score?

Car-N-Credit is a buy here pay here car dealership. A buy here pay here (BHPH) dealership is one of the best places for people with negative or no credit to find a vehicle because it’ll finance your vehicle for you regardless of whether you have bad credit or lack of credit. You can walk onto the lot, pick out your vehicle, get financing, and drive off with your car the same day. Come back to us to make convenient payments per your payment schedule.

At Car-N-Credit, we offer options for people with no credit and people with bad credit to get into a vehicle they can afford without faulting you because of your credit. Other auto dealerships typically turn away customers with lower than a “Good” credit score of at least 670 or above. We want you to build your credit with a little help from us, which is why our loan options are designed for people just like you.

Bad Credit/No Credit Car Loan

We offer bad credit car loans that we make specifically for people with bad or no credit. There are no credit checks, so you won’t be penalized for having a less than stellar credit score.

Credit Reporting

Another way we stand out from other car dealerships is that we report to the credit bureau on your behalf every month, unlike some places that only report bi-monthly, quarterly, or even semi-annually. That means that you’ll get credit for making on-time payments in full as quickly as possible. Every time we update the credit bureau with your positive payment history, your credit gets a positive mark.

It’s up to you to do the work to improve your credit by only financing what you can reasonably afford and making your payments on time. But, EZ Pay Cars can certainly help you reach your goals quicker with our financing options for people with poor or no credit. Check out our inventory online and then contact us at (772) 403-2950 to learn more about your loan options.

Buy Here Pay Here Car Purchasing Tips

Used Car Buy Here Pay Here Purchasing Tips

Finding the right car from the right dealer is a very important decision. Here are some tips to assist you in making an educated decision. Follow these simple tips, and you be sure to find the right buy here pay here used car dealer.

- Make sure you’re working with a used car dealer that is a member in good standing with the BBB. We are proud of the fact that EZ Pay Cars carries an A+ rating with the BBB.

- Find customer reviews about the dealership. Often times, previous used car customers have written reviews about dealers they have worked with in the past. Reading reviews can give you sense of whether or not the used car dealer is reputable or not. You can find our reviews on google my business here.

- Going to a buy here pay here used car dealership verse going to a traditional used car dealership. Everyone’s credit situation is different, so there is no one size fits all when applying for a car loan. Both dealerships will take loan applications, where they differ is by where your used car loan application goes to. A traditional used car dealer will work with major banks to see what your loan rate will be. But there are times when a buy here pay here dealer has advantages over traditional dealerships. For example, those with bad or no credit applying for a used car loan. If you don’t know where to start, buy here pay here dealers are not a bad place. Since buy here pay here used car dealers do not approach banks with your credit information. Therefore your credit score will not be negatively impacted when applying for a car loan. They only report to the major credit bureaus when you make your payments or miss your payments.

- Check to see if the used car dealer employs state licensed sales representatives. All car sales representatives must be licensed and registered with the state of Florida, or whichever state you plan on purchasing from.

- If you’re shopping online, make sure you are provided proper information about the car. In the internet age of today, many used car dealers will try give you minimal information for a few reasons. One being to get you to visit in person without seeing the entire body of the car. By a dealer only providing a few vehicle photos on there website, this gives the dealer a chance to hide any damage to the car prior to visiting in person. This will often lead to a high pressure sales tactic upon your visit. When browsing used car dealer websites, the more pictures of the car, the less the dealer has to hide.

- EZ Pay Cars provides you the shopper with the Carfax report free-of-charge on every vehicle. The vehicles at EZ Pay Cars go through an extensive vehicle safety inspection as well as offer a repair agreement with every vehicle they sell. This is very important because most buy here pay here car dealers won’t offer this to you!

EZ Pay Cars Secret Shopper Review

EZ Pay Cars Receives Perfect Score

Earl Stewart sends his mystery shopper, Agent X, to investigate a Buy Here Pay Here used car dealer listing a car with a Takata airbag recall.

Cosigning Pros and Cons for Car Loans

For many borrowers, cosigning is a fantastic option to consider. However, it also presents some dangers and risks. So, what are the advantages and disadvantages of getting a cosigner? Here, we will explore the pros and cons for cosigning a car loan.

Benefits of Cosigning

- Makes getting accepted for a loan much easier as there are two people signing the contract.

- Can potentially get a lower interest rate.

- Gives the borrowers a chance to improve their credit score.

Risks of Cosigning

- Credit is at stake for both cosigners.

- If one person fails to pay, the other signer is pressured to pay the other person’s part to protect both of their credit scores.

- Relationships can be tarnished if one of the cosigners aren’t responsible with their payments.

- If one cosigner is regularly taking advantage of the other, the other person cannot back out of the contract. Legally, they are bound until the loan is fully paid.

Remember that cosigning is not for everyone and it requires a serious conversation with the other potential cosigner. There should be full trust between both parties before moving forward. For instance, cosigning is a great option if a parent is trying to help their son or daughter. This may not be recommended among two friends.

Need more advice on financing for a car loan? Check out the OkCarz blog for more tips. Want to speak with one of our expert financial representatives? Contact our team through our website or over the phone and we will be happy to schedule a meeting with you.

Can I Apply for a Used Car Loan Online?

How to Get Approved for an Auto Loan at EZ Pay Cars

During this time, it’s important for residents to stay indoors. However, this presents a problem for those in need of an affordable vehicle. How can I shop for a used car while stuck at home? Can I apply for a used car loan online? The simple answer is yes. Here’s how you can get approved for an auto loan at EZ Pay Cars.

Car Loan Pre-Approval Process

The process of applying for a used car loan is easy here at EZ Pay Cars. We only require your name, address, email, phone number, and proof of identity. No social security number is necessary! In addition, we do not charge for the credit check nor will this check affect your credit score. Once you submit the required information listed, you will be given:

- Your current credit score

- Your credit standing compared to the rest of the United States

- The maximum amount you qualify for

Now, where do you go to apply for an auto loan with us? If you are interested in any of our vehicles, get pre-approved by filling out and submitting this online form.

Contact EZ PAY Cars Online

Have questions about your loan offer? Aren’t sure which vehicle will suit your needs? Our staff will be responding to any questions right on our website. To reach out, contact your preferred location here and we will be happy to assist you in any way we can regardless of where you are in your car shopping process.

Found this post helpful? Want more tips to make shopping for a vehicle feel easier? Make sure to check out the EZ Pay Cars blog, where we cover everything automotive all month long!

How Buy Here, Pay Here Dealer Financing Works

Are you currently having trouble securing an auto loan to buy a car? “Buy here, pay here” dealerships offer in-house financing, typically to borrowers with bad credit. While this route is worth considering if your credit isn’t in great shape.

What Is a Buy Here, Pay Here Dealership?

When you sign a contract to buy a car with a traditional car dealership, it passes the contract on to an auto lender, which provides a loan for the purchase. With a buy here, pay here (BHPH) dealership, however, the dealer sells and finances the cars on their lot.

BHPH dealerships specialize in working with people who have bad credit or no credit history at all. As a result, they can provide an opportunity that some borrowers will have a hard time finding anywhere else.

Before you consider a BHPH dealer, though, it’s important to consider both the benefits and drawbacks of doing so.

Pros

- Credit-challenged borrowers can get approved: If your credit is in bad shape or you haven’t had the chance to build a credit history, you may think financing a car through a dealership is out of the question. With a BHPH dealership, however, approval standards are lower than what you’ll find with traditional lenders.

- The process is simple: When you buy a car from a BHPH dealer, you’re done with the entire buying and financing process when you drive off the lot. With traditional dealerships, it can still take a while to complete the loan process, especially if you have bad credit.

Cons

- Costs are high: Because BHPH dealers work exclusively with people with bad or no credit, they tend to charge higher rates than traditional auto lenders that have a mix of borrowers with good and bad credit. Depending on the dealer, you can expect to pay an interest rate as high as the maximum rate allowed by law in your state however, not at EZ Pay Cars. Some dealerships also add a slew of hidden fees to the contract, driving up your total costs. However, not at EZ Pay Cars!

- Selection is limited: Instead of picking a car and then talking about financing, BHPH dealerships first determine your eligibility, then show you which cars you qualify for. This means you might have fewer options than you would with a traditional dealer.

- Expect to make a large down payment: Working with bad-credit borrowers carries a certain amount of risk. To help mitigate that risk, BHPH dealers typically require a larger down payment than a traditional dealership might expect. If you don’t have much cash on hand, it will limit your choice of cars.

How Do Buy Here, Pay Here Dealerships Affect My Credit Score?

EZ Pay Cars auto lender near Stuart, Fl reports your payment activity to two of the credit reporting agencies (TransUnion, and Equifax), which can help improve your credit score if you’re making regular on-time payments. But that’s not always the case with BHPH dealerships, especially if it’s a small outfit for which the costs of reporting would be too high. However, EZ Pay Cars does report your payment history to the credit agencies.

That said, applying for a loan with a BHPH dealer likely won’t impact your credit score negatively either. Many such dealers don’t run a credit check when you apply for a loan, so you won’t see a hard inquiry on your credit report.

Second-Chance Auto Loans

Second-chance auto loans are loans specifically designed to help people with bad credit get the financing they need. Instead of focusing on your credit, second-chance auto lenders “EZ Pay Cars” typically look at your income and expenses, residency, employment stability, and other factors to determine your eligibility. They are better than the alternatives and will help boost your credit score and get you back on track faster.

The Bottom Line

Getting approved for an auto loan with bad credit or no credit history at all isn’t easy, but it is doable. Buy here, pay here dealerships offer financing to people with less-than-stellar credit. Find out why EZ Pay Cars is different offering reporting to credit agencies, and repair agreements with every auto loan.

Instead, check your credit score and report, and take a step back to consider all your options that can help you achieve your goal and cost you less in the long run.