Are you currently having trouble securing an auto loan to buy a car? “Buy here, pay here” dealerships offer in-house financing, typically to borrowers with bad credit. While this route is worth considering if your credit isn’t in great shape.

What Is a Buy Here, Pay Here Dealership?

When you sign a contract to buy a car with a traditional car dealership, it passes the contract on to an auto lender, which provides a loan for the purchase. With a buy here, pay here (BHPH) dealership, however, the dealer sells and finances the cars on their lot.

BHPH dealerships specialize in working with people who have bad credit or no credit history at all. As a result, they can provide an opportunity that some borrowers will have a hard time finding anywhere else.

Before you consider a BHPH dealer, though, it’s important to consider both the benefits and drawbacks of doing so.

Pros

- Credit-challenged borrowers can get approved: If your credit is in bad shape or you haven’t had the chance to build a credit history, you may think financing a car through a dealership is out of the question. With a BHPH dealership, however, approval standards are lower than what you’ll find with traditional lenders.

- The process is simple: When you buy a car from a BHPH dealer, you’re done with the entire buying and financing process when you drive off the lot. With traditional dealerships, it can still take a while to complete the loan process, especially if you have bad credit.

Cons

- Costs are high: Because BHPH dealers work exclusively with people with bad or no credit, they tend to charge higher rates than traditional auto lenders that have a mix of borrowers with good and bad credit. Depending on the dealer, you can expect to pay an interest rate as high as the maximum rate allowed by law in your state however, not at EZ Pay Cars. Some dealerships also add a slew of hidden fees to the contract, driving up your total costs. However, not at EZ Pay Cars!

- Selection is limited: Instead of picking a car and then talking about financing, BHPH dealerships first determine your eligibility, then show you which cars you qualify for. This means you might have fewer options than you would with a traditional dealer.

- Expect to make a large down payment: Working with bad-credit borrowers carries a certain amount of risk. To help mitigate that risk, BHPH dealers typically require a larger down payment than a traditional dealership might expect. If you don’t have much cash on hand, it will limit your choice of cars.

How Do Buy Here, Pay Here Dealerships Affect My Credit Score?

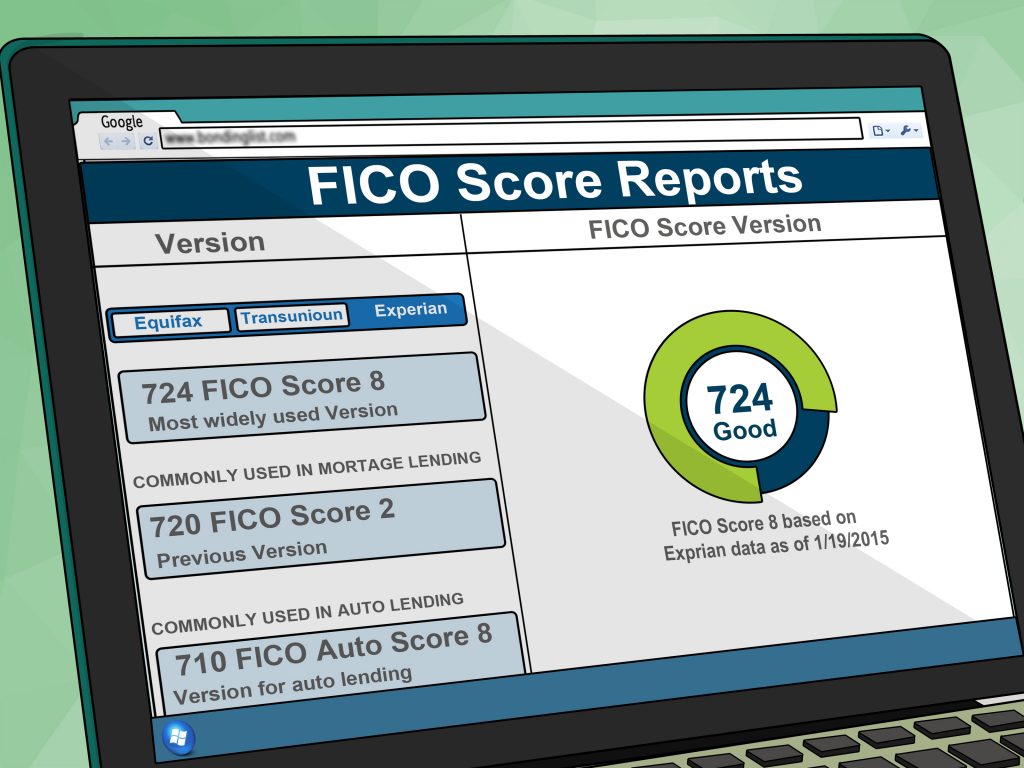

EZ Pay Cars auto lender near Stuart, Fl reports your payment activity to two of the credit reporting agencies (TransUnion, and Equifax), which can help improve your credit score if you’re making regular on-time payments. But that’s not always the case with BHPH dealerships, especially if it’s a small outfit for which the costs of reporting would be too high. However, EZ Pay Cars does report your payment history to the credit agencies.

That said, applying for a loan with a BHPH dealer likely won’t impact your credit score negatively either. Many such dealers don’t run a credit check when you apply for a loan, so you won’t see a hard inquiry on your credit report.

Second-Chance Auto Loans

Second-chance auto loans are loans specifically designed to help people with bad credit get the financing they need. Instead of focusing on your credit, second-chance auto lenders “EZ Pay Cars” typically look at your income and expenses, residency, employment stability, and other factors to determine your eligibility. They are better than the alternatives and will help boost your credit score and get you back on track faster.

The Bottom Line

Getting approved for an auto loan with bad credit or no credit history at all isn’t easy, but it is doable. Buy here, pay here dealerships offer financing to people with less-than-stellar credit. Find out why EZ Pay Cars is different offering reporting to credit agencies, and repair agreements with every auto loan.

Instead, check your credit score and report, and take a step back to consider all your options that can help you achieve your goal and cost you less in the long run.